IPOR Fusion

Transforming liquidity fragmentation

into intelligent DeFi yield optimization

Fusion Vaults are live. Access automated smart yield on Ethereum, Arbitrum, Base and Unichain.

What is IPOR Fusion?

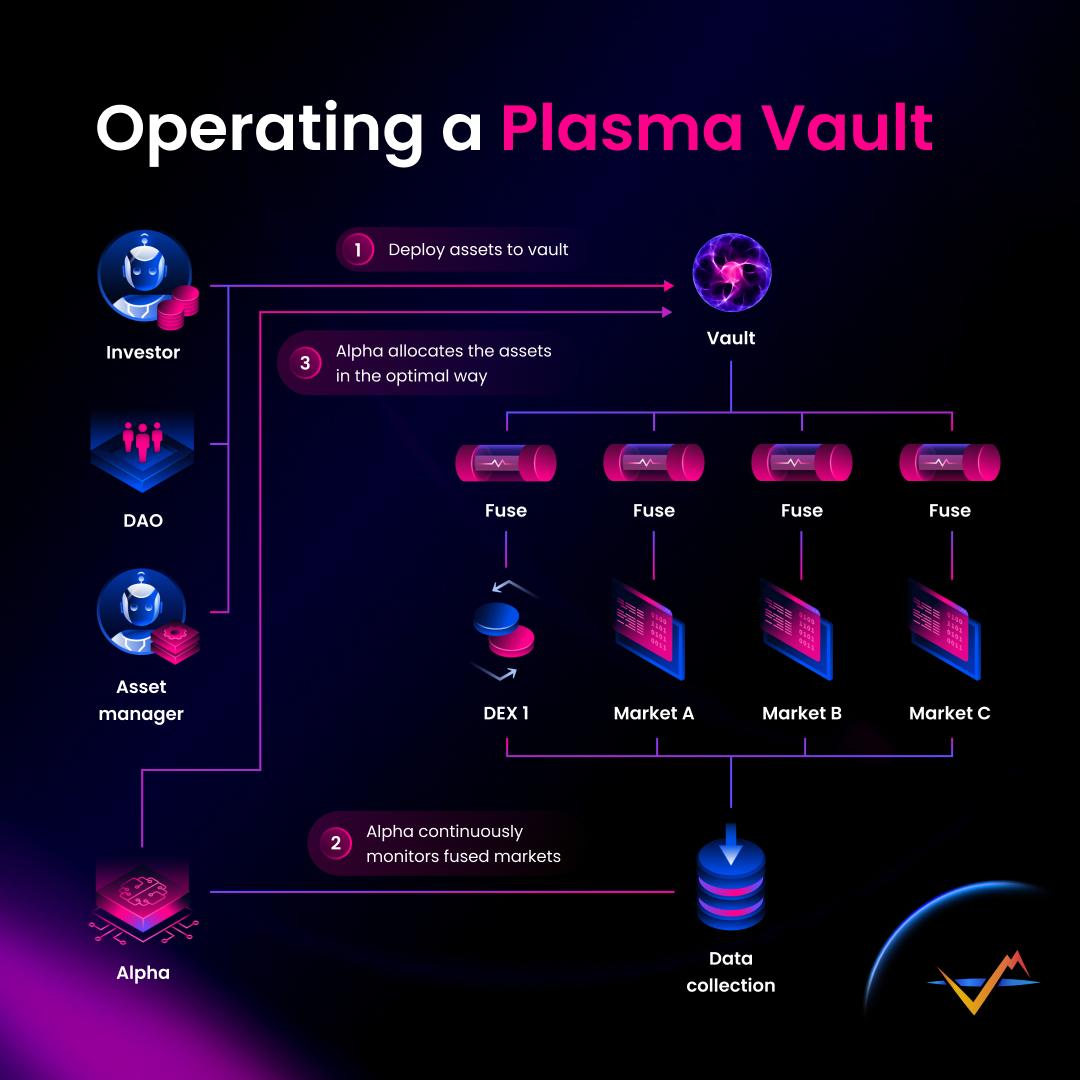

IPOR Fusion is a meta DeFi aggregation, execution & intelligence engine that introduces a unified liquidity framework for on-chain asset management.

Fusion combines various aggregation and routing protocols into a single smart contract layer, automating asset management and maximizing returns across yield sources.

Imagine intelligence-driven execution for looping, carry trades, arbitrage, leveraged farming, and passive lending at your fingertips.

IPOR Fusion for...

- 🔹 Protocols: Optimize capital efficiency and earn yield with idle capital by using Fusion to automate asset allocation

- 🔹 Funds and Fund Managers: Design, deploy and monitor DeFi strategies with ease using Fusion's customizable risk parameters and versatile architecture and attract capital on-chain.

- 🔹 DAO Treasuries: Optimize yield while minimizing risk by utilizing Fusion's capabilities for asset management and strategy composition.

- 🔹 Liquidity providers: Put capital to work allocating to strategies curated by some of the best minds in DeFi

Fusion is all about risk-adjusted returns, empowering any user profile- from the most risk-averse allocator to the most degen DeFi participant- to achieve their target returns!

Why Fusion?

- 🔹 Optimized Yield: Fusion provides intelligence-driven execution for various DeFi operations, including looping, carry trades, arbitrage, and leveraged farming, curated by experts in the field.

- 🔹 Efficiency: Fusion offers a single integration point for accessing multiple yield venues, reducing operational burden and enhancing capital deployment efficiency.

- 🔹 Time to market: DeFi moves fast. Fusion supports quick integration of new protocols, allowing strategists to capture the latest opportunities.

- 🔹 Risk Management: Fusion includes an intelligence layer for automated rebalancing, optimization and risk management, ensuring users can react to market changes effectively. Siloed risk exposure between Fusion vaults ensures potential losses are not socialized.

- 🔹 Security: Built by seasoned developers of battle-tested smart contracts and audited by top-tier firms, Fusion brings peace of mind to users so they can focus on their strengths and priorities.

- 🔹 Network effect without risk “spill-over”: IPOR Fusion adoption offers a growing “palette” of protocol integrations and business logic paired with “siloed” risk exposure protecting users from spillover effects.

From passive liquidity providers, to builders and sophisticated asset managers, IPOR Fusion allows its users to make the most of their resources, focusing on their strengths and expertise and accessing optimized yield (and across the risk appetite).